Da Vinci Postable Remittance, published by HL7 International / Payer/Provider Information Exchange Work Group. This guide is not an authorized publication; it is the continuous build for version 1.0.0 built by the FHIR (HL7® FHIR® Standard) CI Build. This version is based on the current content of https://github.com/HL7/davinci-pr/ and changes regularly. See the Directory of published versions

| Official URL: http://hl7.org/fhir/us/davinci-pr/ImplementationGuide/hl7.fhir.us.davinci-pr | Version: 1.0.0 | |||

| IG Standards status: Trial-use | Maturity Level: 1 | Computable Name: DaVinciPostableRemittance | ||

| Other Identifiers: OID:2.16.840.1.113883.4.642.40.49 | ||||

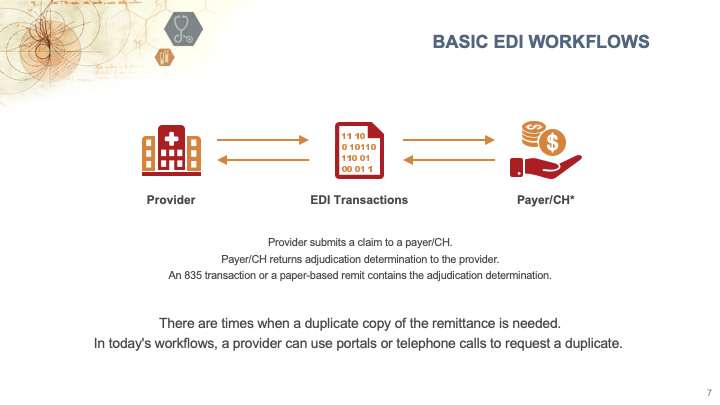

The intent of this FHIR Implementation Guide is to create a Postable Remittance (Remit) FHIR API to retrieve a copy of a previously issued remittance. Rather than going to a number of different payer/clearinghouse portals or making phone calls to payers, this API is intended to make it simpler for providers/vendors to retrieve a copy of the already issued remittance.

The current processes to retrieve missing remits are largely manual – portal retrieval, phone calls, and faxes. The FHIR standard and FHIR API can help automate the workflow and increase adoption of using APIs to alleviate the reliance on manual workflows. Automation opportunities would remove most of the need for human interaction, and, in doing so, reduce the risk of human error and reduce cost. With the increased use of FHIR for other claim and authorization processes (i.e. Prior Authorization, Patient Cost Transparency, etc.), it was felt that developing a FHIR API for this workflow would encourage vendors to include this API.

In scenarios where remits are missing due to any reasons, providers/vendors can request a copy of an already issued 835 or paper remit via the API, and payers/clearinghouses will respond with an attachment which is the copy of the HIPAA compliant 835 or pdf of a paper remit that the payer/clearinghouse already issued. There are existing processes that payers and clearinghouses take to secure their portals and similar processes will be taken to secure access to the APIs defined in this IG such that information is provided to providers only when allowed. See the Privacy & Security page for additional detail.

There is excessive time and effort spent by payer and provider organizations to obtain missing remits.

Missing remits is a prevalent and widespread issue, and the result is that providers don’t get their remits and need to track down a copy. There are many reason remits can go missing:

Clinics/providers owned and employed by hospitals or health systems typically bill ambulatory claims under the same tax ID as the hospital. The hospital and their ambulatory clinics often use different EHR and RCM systems. Many large payers will only remit to a single electronic remittance advice (ERA) receiver/pay-to address, and bank account per Tax ID. The result is remit advice that include both hospital and ambulatory claims are remitted to the hospital EHR/RCM system or the primary receiver’s EHR/RCM system only. The workflows in place to forward remit to the ambulatory EHR/RCM vary in efficiency and automation, resulting in delayed or “lost” remit files needed by the Ambulatory EHR/RCM. Manual remit retrieval from the payer may be the only option for remit file recovery for the ambulatory EHR/RCM.

This implementation guide (and the menu for it) is organized into the following sections:

This guide also relies on a number of parent implementation guides:

| Implementation Guide | Version(s) | Reason |

|---|---|---|

| Da Vinci Health Record Exchange (HRex) | 1.1.0 | |

| FHIR Extensions Pack | 5.2.0 | Automatically added as a dependency - all IGs depend on the HL7 Extension Pack |

| 5.1.0 | Imported by Da Vinci Health Record Exchange (HRex) (and potentially others) | |

| FHIR R4 package : Core | 4.0.1 | Imported by HL7 Terminology (THO) (and potentially others) |

| HL7 Terminology (THO) | 6.2.0 | Automatically added as a dependency - all IGs depend on HL7 Terminology |

| 6.1.0 | Imported by Da Vinci Health Record Exchange (HRex) (and potentially others) | |

| 5.5.0 | Imported by US Core (and potentially others) | |

| Public Health Information Network Vocabulary Access and Distribution System (PHIN VADS) | 0.12.0 | Imported by US Core (and potentially others) |

| SMART App Launch | 2.0.0 | Imported by US Core (and potentially others) |

| Structured Data Capture | 3.0.0 | Imported by US Core (and potentially others) |

| US Core | 7.0.0 | Imported by Da Vinci Health Record Exchange (HRex) (and potentially others) |

| 6.1.0 | Imported by Da Vinci Health Record Exchange (HRex) (and potentially others) | |

| 3.1.1 | Imported by Da Vinci Health Record Exchange (HRex) (and potentially others) | |

| Value Set Authority Center (VSAC) | 0.19.0 | Imported by Da Vinci Health Record Exchange (HRex) (and potentially others) |

| 0.18.0 | Imported by US Core (and potentially others) |

This implementation guide defines additional constraints and usage expectations above and beyond the information found in these base specifications.

This implementation guide and the underlying FHIR specification are licensed as public domain under the FHIR license. The license page also describes rules for the use of the FHIR name and logo.

This publication includes IP covered under the following statements.